pay indiana state property taxes online

Have more time to file my. For example you can pay Indiana property taxes in.

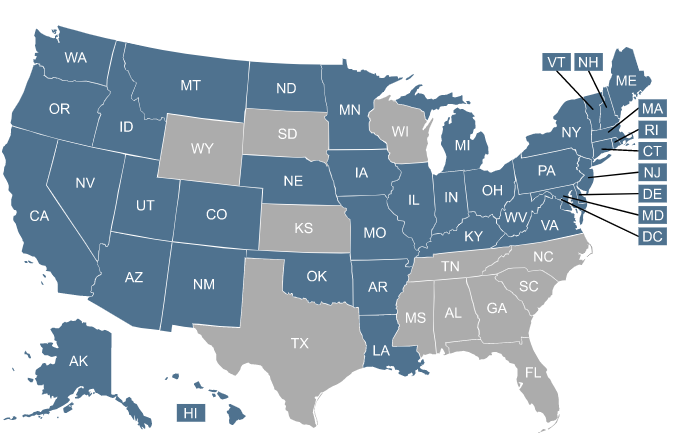

Medicaid Expansion Eligibility Enrollment And Benefits In Your State

The amount of property tax you owe is based on the value of your property.

. 4TAX 4829 or 1888 You can pay your property tax by mail. Through INTIME you can get payments done using credit or electronic checks. Cookies are required to use this site.

Indiana state income tax rate is 323. This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. Using a preprinted estimated tax voucher issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax.

File Homestead and Mortgage Deductions Online. How Do I Pay My Indiana Property Taxes. You can pay your property taxes in several ways including online by mail or in person.

Currently the Indiana corporate tax rate is set to decrease every 12 months through at least 2021. 6 percent from July 1 2017 through June 30 2018. PAY TAXES ONLINE at wwwpaygovus NOTE.

Indianas one-stop resource for registering and managing your business and ensuring it complies with state laws and regulations. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6. DOR Tax Forms Online access to download and print DOR.

Indiana has a flat tax rate meaning youre taxed at the same 323 rate regardless of your income level or filing status. Your browser appears to have cookies disabled. 575 percent from July 1 2018.

The transaction fee is 25 of the total. ATTENTION-- ALL businesses in Indiana must file and. Full and partial payments accepted.

Pay Your Property Taxes. La Porte County Government accepts online payments for Traffic Tickets Probation Fees Property Taxes and more. Update Tax Billing Mailing Address.

Transparency in Coverage TIC General Contact Info Howard County Admin. You can pay your property tax over the phone by calling 317327. Or one of DORs downtown locations or district offices so that the funds can be paid by cash just one.

County Rates Available Online-- Indiana county resident and nonresident income tax rates are available via Department Notice 1. The Indiana Department of Revenue and county treasury offices offer state residents more than one way to pay their taxes. If you have an account or would like to create one or if you.

Pay by phone toll free. Welcome to the State of Indiana Personal Property Online Portal PPOP-IN a convenient online portal through which taxpayers can file their personal property returns. In case of delinquent taxes the sale of real property to pay for such delinquencies may be ordered by the treasurer.

Your total payment including the credit card online transaction fee will be calculated and displayed prior to the completion of your transaction. Call 855-423-9335 with questions.

Deducting Property Taxes H R Block

New Flavor How Hops Are Growing In North Carolina North Carolina Agriculture New Flavour

2022 Sales Tax Holidays Back To School Tax Free Weekend Events

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Treasurer Franklin County Indiana

No Fresh Start In 2021 Will States Let Debt Collectors Push Families Into Poverty As Pandemic Protections Expire Web Version National Consumer Law Center

Louisiana Quit Claim Deed Form Quites Louisiana Louisiana Parishes

Indiana Sales Tax Small Business Guide Truic

Little Known Veteran Benefit Eliminates Up To 15 Years Of Mortgage Payments Pay Off Mortgage Early Mortgage Payoff Refinance Mortgage

How Do State And Local Individual Income Taxes Work Tax Policy Center

2022 Real Estate License Reciprocity Chart Portability Guide 2022 Updated

Kasuti Of Karnatak Indira Joshi 1963 Textiles Folk Art Folk Folk Art Folk Embroidery

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep